Economists vs. Algorithms: Why Algorithms Often Outperform Economists in Forecasting

In the area of forecasting, particularly within financial markets and real estate, a significant debate exists between the efficacy of economists versus algorithms. Economists traditionally use theoretical models and historical data, while algorithmic approaches leverage large datasets and computational power to identify patterns and predict trends. This article explores the reasons why algorithms frequently outperform economists, supported by the success of Renaissance Technologies, a leader in algorithmic trading.

Why Economists Struggle with Forecasting

- Model Limitations: Economic models often rely on simplifying assumptions such as rational behaviour and market efficiency, which do not always hold true in real-world scenarios.

- Retrospective Bias: Economists' models typically analyse historical data, which can be unreliable for predicting future events in dynamic markets.

- Data Constraints: Traditional economic forecasting uses aggregated data, potentially missing important local or sector-specific trends.

- Human Bias: Economic forecasts can be influenced by forecasters' biases, affecting the accuracy and objectivity of predictions.

- Complex Interdependencies: Real estate markets involve numerous interdependent factors, making comprehensive modelling challenging.

Why Algorithms Excel in Forecasting

- Data-Driven Insights: Algorithms, especially those using machine learning, can quickly and efficiently analyse vast amounts of data, identifying patterns and correlations.

- Adaptive Learning: Machine learning algorithms improve with exposure to more data, adapting to new trends and anomalies for enhanced accuracy.

- Multi-factor Analysis: Algorithms can simultaneously process multiple factors, capturing complex interdependencies within the data.

- Real-Time Processing: Algorithms continuously update predictions as new data becomes available, offering immediate insights crucial in fast-moving markets.

- Reduction of Human Bias: While algorithms can still reflect the biases of their creators, their decisions are primarily based on data and statistical analysis, reducing human bias.

Case Study: Renaissance Technologies

Renaissance Technologies, founded by James Simons, is renowned for its algorithmic trading strategies, particularly its Medallion Fund. The fund's performance metrics highlight the superiority of algorithmic approaches:

- Consistent High Returns: From 1988 to 2018, the Medallion Fund achieved an average annual return of 66% before fees and 39% after fees.

- Minimal Drawdowns: The fund has maintained relatively low drawdowns compared to traditional hedge funds, showcasing its risk management capabilities.

- Market Independence: Renaissance's algorithms have performed well across various market conditions, proving their robustness and adaptability.

- Significant Outperformance: In comparison, the S&P 500's average annual return was around 11% over the same period.

These metrics underscore the effectiveness of Renaissance's data-driven, adaptive approach, enabling the fund to outperform traditional models significantly.

Application in Real Estate

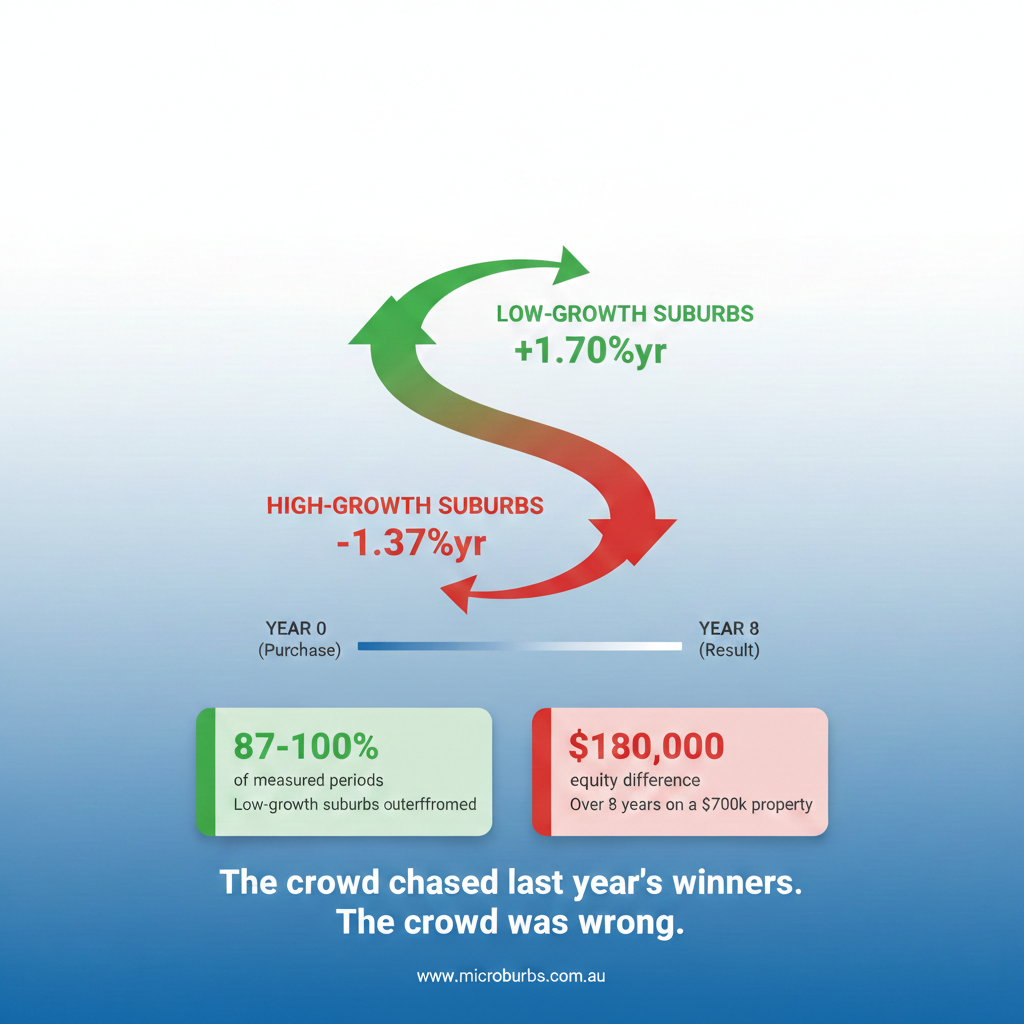

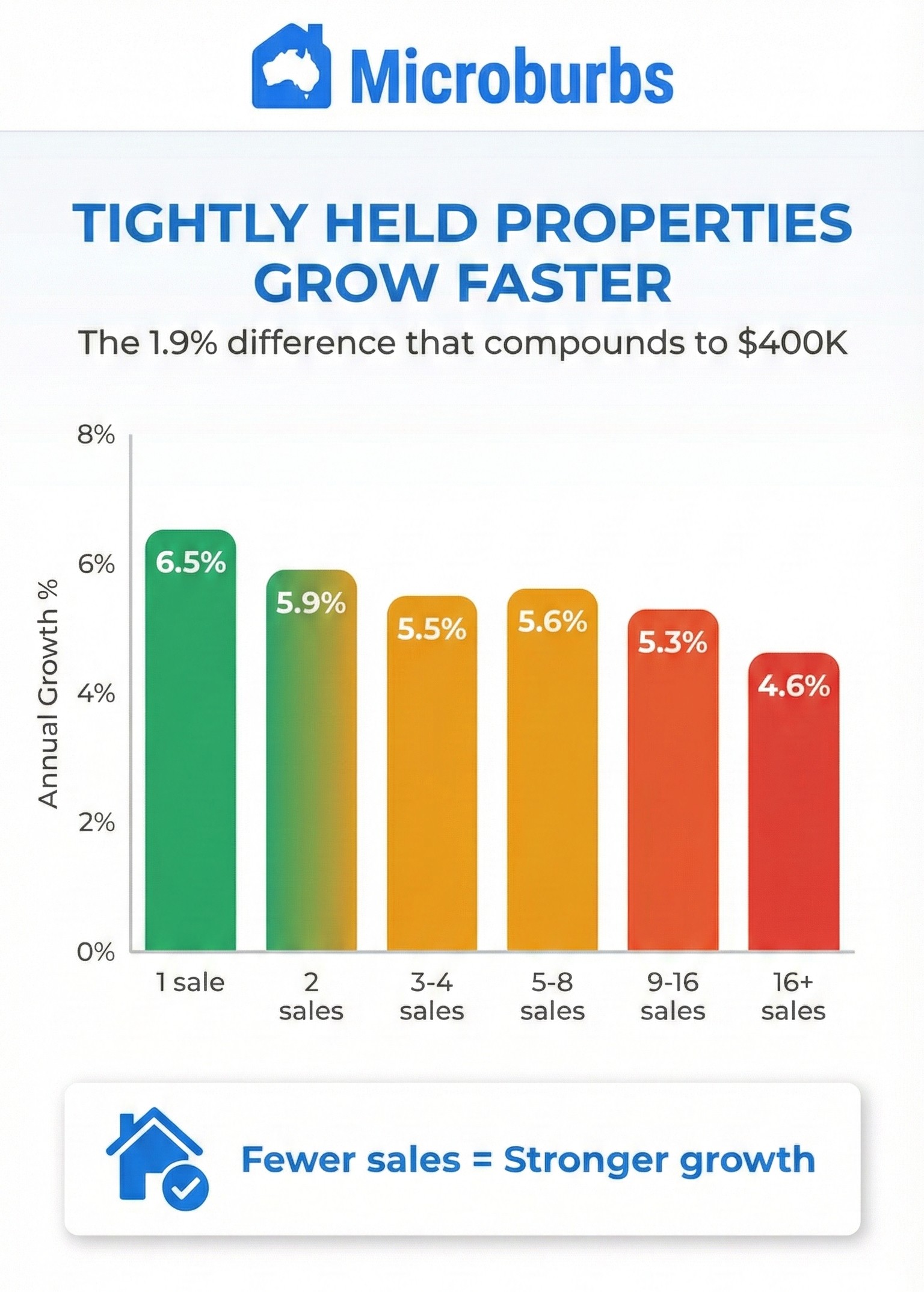

In the real estate sector, algorithms provide substantial advantages over traditional economic models:

- Predicting Property Values: Algorithms can analyse numerous factors, including local market trends, economic indicators, and property specifics, to predict future property values accurately.

- Market Timing: Continuous data analysis enables algorithms to identify optimal buying or selling times, maximising returns.

- Risk Assessment: Algorithms assess investment risks by analysing economic conditions, local development projects, and demographic trends.

Algorithmic Forecasting at Microburbs

At Microburbs, we leverage advanced algorithmic models to provide precise and actionable insights for real estate forecasting. Our proprietary algorithm is trained on 33 years of comprehensive real estate data, which includes over 90 million real estate listings, encompassing various market cycles and conditions. This extensive dataset allows our models to identify patterns and trends that traditional methods might miss. Our algorithm consistently outperforms the market, delivering predictions with an average accuracy that beats the market by 7.8%. By utilising machine learning and real-time data processing, Microburbs offers unparalleled forecasting capabilities, helping clients make informed investment decisions with confidence.

While economists offer valuable theoretical insights and contextual understanding, algorithms deliver superior data processing capabilities and predictive accuracy. Renaissance Technologies' success exemplifies the potential of algorithmic models to outperform traditional economic approaches. For the real estate industry, incorporating algorithmic models can enhance prediction precision and reliability, offering a competitive edge in the market. As the industry evolves, balancing economic intuition with algorithmic precision will be crucial for future forecasting success.